7% CAP

no data

Mixed Use

Property Type

$1,647,417

Net Operating Income (NOI)

2 unit(s)

Total Units

7%

CAP RATE

2

Leasable Doors

No price data

Price per unit

Fortis Net Lease is pleased to present the Main Place of Royal Oak multi-tenant mixed use buildings located at 410 & 500 South Main Street in Downtown Royal Oak, Michigan 48067. Main Place of Royal Oak consists of two separate buildings totaling 61,965 rentable square feet, on two separate parcels, totaling 1.006 acres of land. The current occupancy is 100%. However, the 10 year cash and year 1 NOI has a 3% vacancy factor applied as the Downtown Royal Oak retail market reflects a 3% overall vacancy. The Average Weighted Lease Term (WALT) is approximately 12+ Years.

Phase I is located at 500 South Main Street and consists of street level retail space with second floor office space. The 45,436 total square feet are 100% occupied by four tenants. Harlet Ellis Deveraux took occupancy January of 2023 with a lease running through October 31, 2035. The third largest tenant, Tequila Blue/526 Main, a dueling piano bar and night club, occupies 9,154 square feet on the first and

second floors through February 2032. Buffalo Wild Wings (lease guaranteed by Diversified Restaurant Holdings, Inc. NASDAQ : BAGR) recently renewed their lease for 5 years that runs through March of 2030. New Cingular Wireless has a Wi-Fi tower on the roof of the building.

Phase II is located at 410 South Main Street and consists of first floor retail space as well as has 70 loft style residential condominium units (Skyloft’s) on floors four through eight plus private parking on floors two and three (106 spaces) above the street level retail space. The Skyloft’s Royal Oak are individually owned and not included in this opportunity. Phase II is 100% occupied by six tenants. The largest tenant, HopCat, occupies 11,208 square feet of space through February 5, 2033.

All of the tenants are on triple net leases (NNN) except 1 in which they are responsible for reimbursing for Their pro rata share of real estate taxes, property insurance and common area maintenance (CAM). Additionally, some tenants are also reimbursing the landlord for their pro-rata share of management fees on top of operating expenses. The landlord is responsible for managing common area expenses as well as repairs and replacement of the roof and structure, which would be minimal on Phase II due to the nature of the condominium. The subject property provides a low risk, low management investment opportunity, while still providing risk diversification.

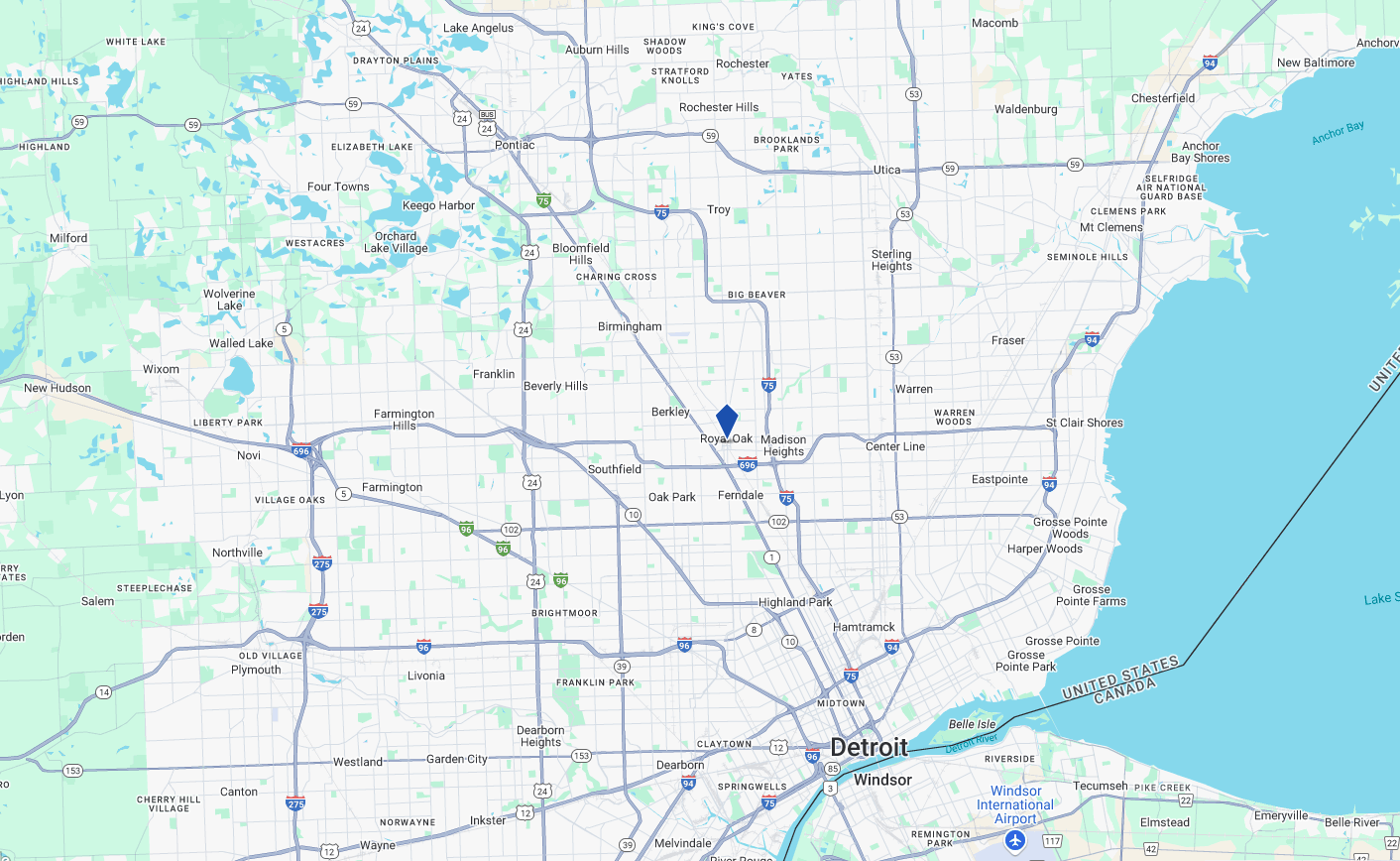

This asset further benefits from its location in downtown Royal Oak, Michigan. Downtown Royal Oak has undergone a major renaissance over the past two decades. Currently there are are nearly 2,000 newer individual housing units within on half mile from the subject property and constant new commercial developments in the downtown area. Royal Oak has become the “In” place to dine, shop and live. This dense demographic area has over 363,000 residents within a five-mile radius which allows the tenants a strong, neighborhood client base. Main Place of Royal Oak represents a truly unique investment opportunity for an investor to own a trophy property in impeccable condition and in an excellent location, which is a proven asset class demonstrating a durable financial resilience in today’s economic environment.